Asset Utilization Ratio Formula

In business asset utilization is a ratio that measures how efficient an organization is in using the assets at its disposal to make money and turn a profit. Average Total Asset of X ltd INR 18000.

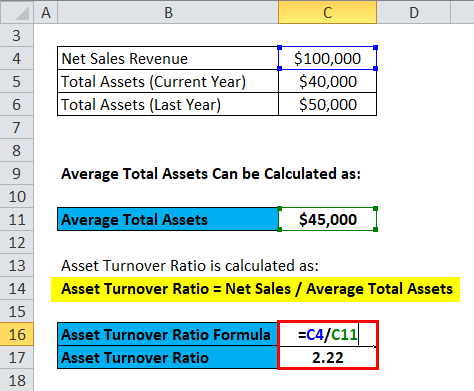

Asset Turnover Ratio Formula Calculator Excel Template

This script is one of several termed as operational ratios.

. What is the purpose of asset. Four key metrics measure asset utilization. So to calculate the average total assets we need to take the average of the figure at the beginning of the year and of the figure at the end of the year ie.

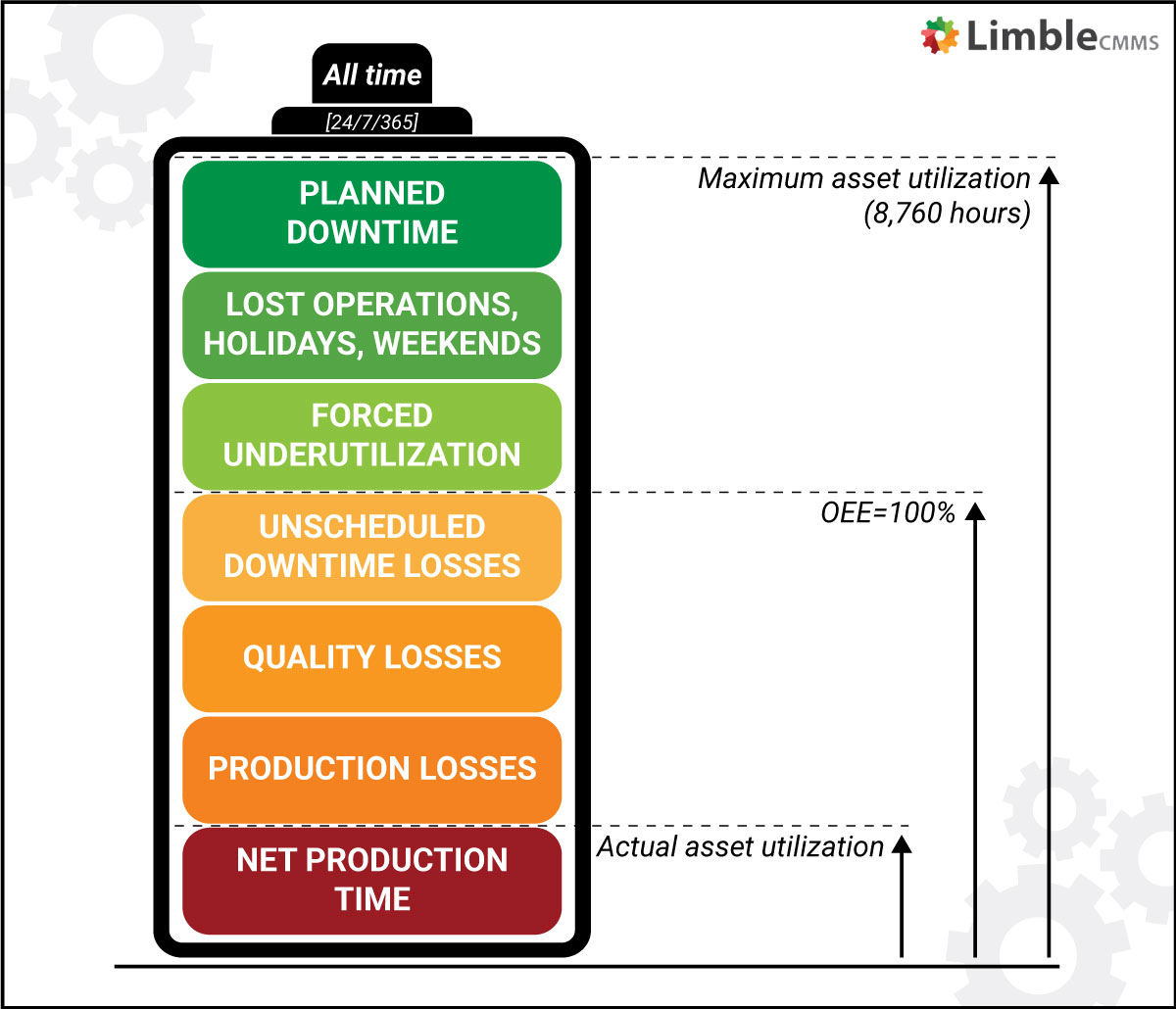

OEE Availability x Performance x Quality. Assets management ratio is otherwise called resource turnover rates and resource productivity. Asset turnover ratio measures the value of a companys sales or revenues generated relative to the value of its assets.

The formula is as follows. A lower ratio indicates poor efficiency which may be due to poor utilization of fixed assets poor collection methods or poor inventory management. The asset utilization ratio calculates the total revenue earned for every dollar of assets a company owns.

This ratio divides net sales by net fixed assets calculated over an annual period. US 23660 billion US21930. You may notice that the formula for OEE consists of three other metrics.

Activity Ratios or asset utilization ratios are measures of a companys operating efficiency specifically with regard to managing its assets. The usage of ratio assessment particularly with small business is of biggest value whenever performed as time goes by to track changes in business performances as well as assess the. Asset to Sales Ratio is calculated using below formula.

For example with an asset utilization ratio of 52 a company earned 52 for. There are also specialized ratios that deal with such issues as sales returns repairs and maintenance fringe benefits interest expense and overhead rates. Enter the current and fixed assets values.

The net fixed assets include the amount of property plant and equipment less the. The formula for Fixed Asset Turnover Ratio can be calculated by using the following steps. The number of usable units from a process calculated as the number of units finished divided by the number.

Firstly determine the value of the net sales recognized by the company in its income. Asset to Sales Ratio Total Revenue Average Total Assets. This measures the relationship of sales dollars earned for dollars invested in assets.

Asset utilization ratios also called activity or efficiency ratios measure how efficiently the companys day to day operations are. Mon 10 Aug 2020 at 433 PM. The Asset Turnover ratio can often be used as an.

The ratio is calculated by dividing a companys net sales for a specific period by the average total assets the company held over the same period. They demonstrate the capacity of an organization to change over its resources into deals. Asset to Sales Ratio 12000.

Asset utilization ratios measure the efficiency with which the firm uses its assets to generate sales revenue to reach a sufficient profitability level. The asset turnover ratio can be.

Asset Turnover Ratio Formula And Calculator

Activity Ratio Formula And Calculator

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

What Is Asset Utilization And How To Calculate It

0 Response to "Asset Utilization Ratio Formula"

Post a Comment